The growing trade tensions between the U.S. and China are having a strong impact, directly affecting the global supply chain.

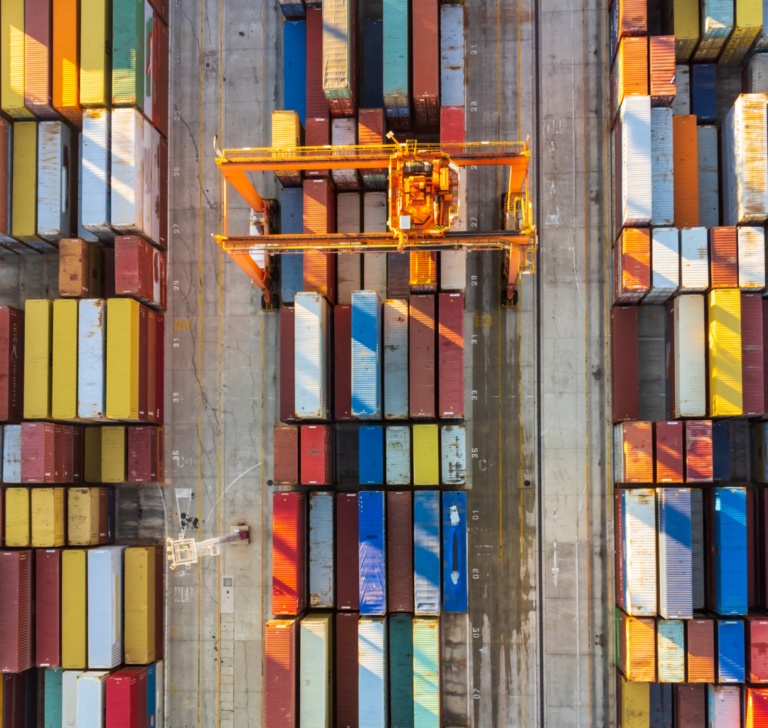

The escalating trade tensions between the United States and China are significantly impacting maritime cargo transport, directly affecting the global supply chain. According to a report by CNBC, U.S. importers have been warned about a notable increase in canceled ship departures from Chinese ports, a consequence of declining order demand. Companies like HLS Group have recorded up to 80 canceled sailings, reflecting a significant adjustment in transpacific services.

The maritime alliance ONE has indefinitely suspended a key route connecting ports such as Qingdao, Shanghai, and Vancouver, while other active routes have removed stops at U.S. cities like Wilmington, North Carolina. These decisions are part of a broader strategy to streamline services in response to lower container demand and reflect a reconfiguration of trade between Asia and North America.

Economic Impact Beyond the Sea

The drop in container volume—estimated between 640,000 and 800,000 units—is affecting several links in the U.S. economy, including ports, logistics companies, ground transportation, and warehousing. This is a direct result of lower cargo volumes leading to reduced operational activity, which in turn means lower revenue from port fees.

The World Trade Organization has warned about worsening global trade prospects. Companies like JB Hunt have already reported uncertainty in their financial results, and experts anticipate a significant—though not total—decline in shipments from China. Bruce Chan from Stifel noted that tariff policy has created uncertainty around consumer behavior, leading retailers to act cautiously in managing inventory, especially after the pandemic-induced surpluses.

China accounts for approximately 30% of all U.S. containerized imports and around 54% of imports from Asia (down from 67% in 2018). In recent days, imports from China have reportedly dropped by 64% as a result of the tariff war.

Decline in Bookings and Operational Adjustments

The CNBC report also highlights that between late March and early April, there was a sharp drop in ocean freight bookings on global trade routes, with products like apparel, textiles, and accessories showing declines of over 50%. This downturn has forced shipping lines to cancel routes or reduce frequency, also affecting U.S. exports to Asia.

Carriers are implementing strategies such as canceling sailings, using smaller vessels, or reducing sailing speeds to optimize operational capacity. While these measures might push shipping rates down, there is also a risk—similar to during the pandemic—that they could trigger sharp rate increases due to limited space.

Uncertain Outlook

In this context, countries like Vietnam are emerging as alternatives for U.S. imports. Analysts say this shift reflects a reconfiguration of trade routes driven by tariff uncertainty. The recent 90-day pause on tariffs for countries other than China has also encouraged earlier shipments, accelerating activity from alternative markets.

Undoubtedly, the current situation remains volatile. Carriers are trying to fill their vessels to capacity to maintain profitability, while importers continue adjusting their decisions based on shifting trade policies. All signs suggest that the effects of this U.S.-China trade dispute will continue to impact international trade in the coming months.

Rutas congeladas tras ciclón bomba: hielo negro, nieve récord y alto riesgo para camiones

Las rutas congeladas siguen afectando el transporte de carga luego del impacto de un ciclón bomba, con hielo negro, carreteras colapsadas, apagones y condiciones invernales que se extienden desde el Golfo hasta Nueva Inglaterra.

Año Nuevo Lunar 2026: tradiciones milenarias, energía renovada y celebraciones masivas

El martes 17 de febrero comenzará el Año del Caballo de Fuego según el calendario lunar. La celebración, una de las más importantes del mundo, combina rituales ancestrales, reuniones familiares y festejos masivos tanto en China como en ciudades de Estados Unidos, especialmente en California.

Cómo la logística y el transporte harán posible la carrera Freedom 250 Grand Prix en Washington

El Freedom 250 Grand Prix será la primera carrera callejera de IndyCar en Washington, D.C., del 21 al 23 de agosto, y activará un enorme operativo de logística, transporte de carga y gestión urbana en la capital de Estados Unidos.

Día de la Marmota: qué significa para el trensporte que “Phil haya visto su sombra”

El pronóstico de la marmota más famosa de Estados Unidos anticipa más semanas de invierno, una señal clave para el transporte por carretera y la planificación de rutas en temporada de frío.

Amor en la carretera: las mejores aplicaciones de citas para camioneros

Si estás en búsqueda de alguien para recorrer el viaje largo, estas son las mejores aplicaciones de citas para conductores de camiones Dicen que el

Las ciudades con mayor congestión de EE.UU. y del mundo en 2025

El Índice de Tráfico TomTom anual elabora una clasificación de las ciudades con mayor congestión del mundo. El índice anual TomTom Traffic Index, presenta un