Digital freight forwarding is transforming the logistics industry through artificial intelligence, automation, and cloud-based platforms. According to DataM Intelligence, the global market is expected to surpass US$50 billion by 2031, while the U.S. alone will reach US$15.04 billion, driven by e-commerce growth, nearshoring, and the digitalization of supply chains.

For decades, freight forwarding has been defined by manual processes, fragmented communication, and limited operational visibility. Phone calls, email chains, spreadsheets, and disconnected systems were the backbone of a business model that often struggled with inefficiencies, delays, and a lack of real-time insight.

Today, that model is undergoing one of the most profound transformations in its history.

Digital freight forwarding is not simply modernizing how shipments are quoted, booked, and tracked—it is fundamentally redefining how logistics intermediaries operate, compete, and create value.

According to a recent report by DataM Intelligence, the global digital freight forwarding market reached US$8.54 billion in 2023 and is projected to grow to US$50.14 billion by 2031, representing a compound annual growth rate of 25.04%. In the United States, one of the most dynamic and competitive logistics markets in the world, the sector is expected to reach US$15.04 billion by 2031.

This rapid growth is not coincidental. It is the direct response to a logistics environment that has become more complex, volatile, and demanding than ever before.

From emails and phone calls to intelligent platforms

Traditional freight forwarding has long relied on human coordination across multiple actors: shippers, carriers, customs brokers, warehouses, and port authorities. While this model worked for decades, it left little room for real-time optimization, scalability, or predictive decision-making.

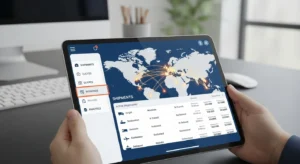

Digital freight forwarding replaces this fragmented structure with centralized, cloud-based platforms that integrate the entire logistics workflow into a single digital environment.

These platforms enable:

• Real-time automated quotes

• Digital booking and documentation

• End-to-end shipment tracking

• Predictive delay alerts

• Cost and route optimization

• Performance analytics and reporting

Powered by artificial intelligence, big data, and predictive analytics, these systems can anticipate disruptions, suggest alternative routes, and continuously optimize supply chain performance.

The result is a faster, more transparent, and far less manual operation.

Who is leading the transformation

Companies such as Flexport, Forto Logistics, Agility, Saloodo!, iContainers, Zencargo, and others are at the forefront of this shift. They are moving the industry away from traditional brokerage models toward data-driven, platform-based ecosystems.

Instead of acting only as intermediaries, these digital forwarders are becoming technology providers, logistics intelligence hubs, and operational partners.

Their platforms connect air, ocean, and ground transportation into unified interfaces that allow shippers to manage complex global movements with unprecedented clarity.

Their value proposition is built on three core pillars:

• Full process visibility

• Reduced operational friction

• Improved cost and time control

By democratizing access to advanced forwarding tools, these platforms are leveling the playing field for small and mid-sized businesses that previously lacked the resources of multinational shippers.

The role of e-commerce and nearshoring

Two macro trends are accelerating the adoption of digital freight forwarding: the rise of e-commerce and the regionalization of supply chains.

E-commerce demands shorter delivery times, dynamic inventory flows, and full traceability. Traditional forwarding systems—built for static, long-cycle shipping—cannot meet these expectations.

At the same time, nearshoring is reshaping trade flows. More U.S. companies are relocating parts of their production to Mexico and Latin America to reduce geopolitical risk, shorten lead times, and build more resilient supply networks.

This new geography of trade requires digital platforms capable of coordinating multiple origins and destinations, navigating different regulatory environments, and maintaining full operational visibility across borders.

Digital freight forwarding provides the infrastructure needed to manage this complexity.

Data becomes a strategic asset

One of the most important changes introduced by digital freight forwarding is the elevation of data from a byproduct to a core strategic asset.

These platforms collect vast amounts of information on transit times, costs, disruptions, carrier performance, seasonal patterns, and congestion points. When analyzed using AI and machine learning, this data enables predictive logistics.

Instead of reacting to problems after they occur, shippers can anticipate them before they happen.

This shift turns freight forwarders into intelligence providers—not just service intermediaries.

For cargo owners, this means decisions based on real-time insights rather than historical assumptions.

Less friction, more efficiency

Fragmentation has long been one of the biggest weaknesses of traditional forwarding. Each leg of a shipment often involved a different actor, using different systems, with little coordination.

Digital platforms unify these processes into a single environment, dramatically reducing friction.

This leads to:

• Fewer human errors

• Fewer delays

• Lower administrative costs

• Reduced reliance on manual workflows

Automation also frees human teams from repetitive tasks, allowing them to focus on higher-value activities such as exception management, strategy, and customer experience.

What to expect by 2031

The projected growth of digital freight forwarding is not driven by hype—it reflects a structural need.

Global supply chains are more complex than ever. Companies now require:

• Greater visibility

• Stronger control

• Higher predictability

• Faster execution

Digital freight forwarding responds to all of these demands.

By 2031, the market will not only be larger—it will be smarter. Platforms will integrate more advanced AI, deeper automation, and increasingly sophisticated predictive tools.

Forwarding will shift from a reactive service to a proactive planning system.

A true paradigm shift

Freight forwarding is no longer defined by phone calls, email threads, and spreadsheets.

It is now defined by platforms, data, and automation.

The growth of the digital freight forwarding market is not a temporary trend—it is the logical evolution of an industry adapting to a faster, more volatile, and more interconnected world.

And all signs indicate that this transformation is only just beginning.

DOT unveils possible AI strategy to enforce CDL regulations

The DOT is looking to adopt AI and advanced data analytics to improve the accuracy and effectiveness of enforcement measures. On January 14, the 105th

U.S. Trucking Defies the January Slowdown

Contrary to seasonal patterns, the U.S. trucking market entered 2026 without the traditional January slowdown. Capacity, pricing, and demand indicators suggest the industry remains tighter than expected, driven by inventory shifts, resilient consumer spending, and a reconfiguration of supply chains.

Using one of these ELD? FMCSA updates revoked device list

The FMCSA continues its safety campaign against electronic logging devices (ELD) that do not comply with the regulations established by the agency. The Federal Motor

Digital Freight Forwarding Is Reshaping Global Logistics

Digital freight forwarding is transforming the logistics industry through artificial intelligence, automation, and cloud-based platforms. According to DataM Intelligence, the global market is expected to surpass US$50 billion by 2031, while the U.S. alone will reach US$15.04 billion, driven by e-commerce growth, nearshoring, and the digitalization of supply chains.

Texas Has Revoked 6,400 Commercial Licenses to Strengthen Road Safety

The review of commercial licenses is part of a federal audit process and updated administrative criteria aimed at aligning work permits, driving credentials, and compliance standards. For the transportation sector, this new licensing landscape marks a phase of regulatory adjustment, greater predictability, and reinforced safety conditions on highways and major freight corridors.

$75,000 brokers bond rule now in effect

The FMCSA has the authority to suspend the operating license of transportation brokers whose minimum financial security falls below $75,000 After numerous debates, mixed opinions,