The recently announced EPA emissions regulations are expected to increase the cost of trucks by approximately $30,000

The recently announced EPA emissions regulations are having a significant impact on the transportation sector, especially in the Class 8 truck segment. These regulations are expected to increase the cost of trucks by approximately $30,000, triggering a debate about the anticipation of purchases to avoid additional costs and associated uncertainty.

Fleets are seriously considering advancing their orders for Class 8 trucks in an effort to navigate the economic effects of the new regulations. This push towards pre-purchasing is supported by the current context of supply chain disruptions and a growing demand for trucks, especially after the Covid-19 pandemic.

According to trucknews.com, ACT Research forecasts a significant pre-purchase, anticipating that Class 8 truck demand could reach 100,000 units before the EPA regulations come into effect. Truck manufacturers, aware of this projection, are gearing up for an increase in demand and adjusting their production strategies accordingly. Despite optimistic projections, there is skepticism in the sector about manufacturers’ ability to meet a potential massive pre-purchase.

Class 8 truck pre-purchase strategies

For fleets considering pre-purchase, strategic planning becomes crucial. It is essential to discuss with original equipment manufacturers (OEMs) how construction time slots will be allocated, especially after the allocation challenges experienced during the Covid-19 pandemic. Careful allocation will ensure continued availability of vehicles in the future.

Amidst these dynamics, fleets are turning to solid data and detailed analysis to inform their purchasing decisions. Companies like Fleet Advantage are using data from over 50 billion miles to forecast costs and assess the impact on long-term purchases or leases. This informed decision-making is crucial to ensure long-term profitability and operational efficiency.

In summary, the transportation sector is at a crucial turning point. While projections suggest a significant increase in demand, doubts persist about manufacturers’ ability to meet this demand. However, with strategic planning and the use of solid data, fleets can make informed decisions that enable them to successfully navigate this period of change and challenge in the freight transportation industry.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

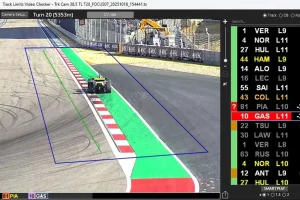

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,