The investigation into Powell has raised global concerns over a potential threat to the independence of the U.S. central bank.

In the new episode of the podcast “Noticias Sobre Ruedas” (“News on Wheels”), market specialist and journalist Julián Yosovitch analyzes the growing tensions between President Donald Trump and the Federal Reserve, amid an economy facing inflation, as well as fluctuations in employment and interest rates.

The Chairman of the U.S. Federal Reserve (Fed), Jerome Powell, confirmed that the Department of Justice has launched a criminal investigation into the renovation of the central bank’s headquarters, a project valued at US$2.5 billion. Powell described the investigation as a political attack, linked to pressure from former President Donald Trump for the Fed to cut interest rates more aggressively.

According to Powell, Trump is seeking a much more accommodative monetary policy to accelerate economic growth and lower financial costs in the United States. However, the Fed has maintained a more conservative stance due to renewed inflationary risks following the tariff increases implemented during the early months of Trump’s administration.

Tensions between Trump and the Fed: the investigation into Powell

From a medium- to long-term perspective, Powell’s leadership is viewed positively. He took office in 2019 and, just one year later, had to confront the impact of the pandemic. In that context, the Fed implemented an ultra-expansionary monetary policy, cutting rates to historic lows and launching direct stimulus programs to support consumption, known as “Helicopter Money,” aimed at sustaining economic activity and employment in an economy where two-thirds of growth depends on consumer spending.

This strategy helped prevent an economic collapse but later led to significant inflationary imbalances. In 2022, inflation in the United States peaked at 9.1%. After acknowledging that inflation was not transitory, the Fed implemented the most aggressive monetary tightening cycle since the 1980s. The result was a slowdown in inflation to the current level of 2.7%, without triggering a recession.

While the labor market shows signs of cooling, it remains stable. The unemployment rate stands at 4.4%, close to full employment, though above the previous low of 3.3%. The economy continues to grow, consumption remains solid, and there is no evidence of structural job losses.

The investigation into Powell has sparked global alarm over the potential threat to the independence of the U.S. central bank. Figures such as Christine Lagarde (European Central Bank), Andrew Bailey (Bank of England), and monetary authorities from Brazil, Switzerland, Sweden, Denmark, South Korea, Australia, and Canada issued a joint statement in defense of the Fed. Former Fed Chairs Janet Yellen, Alan Greenspan, and Ben Bernanke also voiced their support, warning that political interference in monetary policy is unacceptable in a developed economy.

U.S. markets: inflation, employment, and interest rates

On the macroeconomic front, recent data showed a slowdown in job creation. In December, 50,000 jobs were added, below the 73,000 expected. Throughout 2025, average monthly job gains totaled just 49,000, the weakest performance without a recession since 2003. Wages rose 0.3% month over month and 3.8% year over year.

December inflation data met expectations: the Consumer Price Index increased 0.3% month over month and 2.7% year over year, while core inflation reached 2.6%. However, wholesale prices surprised to the upside, with the Producer Price Index at 3%, above forecasts. Retail sales also rose 0.6%, highlighting the strength of consumer spending.

Looking ahead to the Fed’s first monetary policy meeting of 2026, scheduled for January 28, markets assign a 95% probability that interest rates will remain unchanged. Rate cuts are expected in June and September, totaling 50 basis points for the year.

Meanwhile, the bank earnings season delivered mostly disappointing results. Citigroup and Wells Fargo missed revenue expectations, while JPMorgan, despite reporting profits, offered cautious guidance. This weighed on markets: the Nasdaq fell 1.7%, the S&P 500 also declined, and the Dow Jones dropped 0.6%, marking a volatile start to 2026 on Wall Street.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

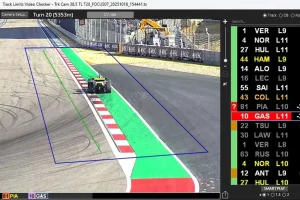

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,