Global Road Freight on Track to Hit USD 5 Trillion by 2033 as e-commerce growth, supply chain restructuring, and technology adoption accelerate demand for road-based cargo transport worldwide.

The road freight industry continues to strengthen its position as one of the core pillars of global logistics. According to estimates from Research Intelo, the global road freight market is expected to reach USD 5.09 trillion by 2033, up from USD 3.22 trillion in 2024, reflecting a compound annual growth rate (CAGR) of 5.1% over the next decade. These figures underscore the strategic importance of road-based cargo transport at a time when supply chains are becoming more complex, delivery expectations are accelerating, and cost and environmental pressures are intensifying.

Growth Driven by Multiple Structural Forces

The expansion of the road freight market is not the result of a single trend, but rather the convergence of several powerful structural forces. One of the most influential drivers is the rapid growth of e-commerce. As online retail continues to expand globally, shipment volumes have risen sharply, particularly in last-mile delivery—the most complex and costly segment of logistics. This surge has forced carriers and fleet operators to scale capacity, optimize routing, and deliver faster, more flexible services across both urban environments and long-haul corridors.

At the same time, the reconfiguration of global supply chains is reinforcing demand for road transport. Companies across industries are prioritizing resilience in response to recent disruptions, leading to supplier diversification, partial reshoring or nearshoring, and tighter inventory management. In this environment, road freight stands out for its flexibility and ability to quickly connect production hubs, distribution centers, and final markets.

Industry and Global Trade Fueling Demand

Industrial expansion remains a key source of sustained demand for road freight services. Sectors such as automotive manufacturing, electronics, and consumer goods rely heavily on consistent, time-sensitive ground transportation to support just-in-time production models and complex distribution networks. Road freight plays a critical role in ensuring continuity across these supply chains.

In parallel, governments around the world are increasing investment in highways, logistics corridors, and cross-border infrastructure to improve freight mobility and reduce congestion. The modernization of road networks, combined with trade agreements and more integrated regulatory frameworks, is helping lower transit times and logistical friction, strengthening the competitiveness of road transport compared to other modes.

Technology Becomes the Operational Standard

Technology has emerged as one of the most transformative forces shaping the future of road freight. Tools that were once considered competitive advantages are now becoming industry standards. These include real-time fleet tracking, advanced route planning systems, artificial intelligence for dispatching and load optimization, and end-to-end cargo visibility platforms.

The adoption of these technologies allows operators to reduce operating costs, improve delivery reliability, and respond more effectively to fluctuations in demand or unexpected disruptions. Just as importantly, digital tools provide greater transparency to shippers and partners, an increasingly critical requirement in global logistics networks that depend on accurate, real-time data.

Headwinds Facing the Sector

Despite strong growth prospects, the road freight market faces several persistent challenges. Fuel price volatility remains one of the most significant risks, directly affecting operating costs and profit margins. Additionally, the industry continues to grapple with driver shortages, a structural issue driven by an aging workforce, demanding schedules, and recruitment challenges.

Regulatory complexity is another growing pressure point. Stricter environmental standards, enhanced safety requirements, and increasingly detailed cross-border documentation obligations are raising compliance costs. To address these challenges, companies are investing in more fuel-efficient fleets, driver training and retention programs, digital compliance systems, and long-term cost management strategies.

Sustainability as a Strategic Imperative

Sustainability has moved from a secondary concern to a central strategic priority within the road freight industry. The transition toward electric trucks for short-haul and urban deliveries, alongside the adoption of biofuels and LNG-powered vehicles for long-distance transport, is gaining momentum. Aerodynamic vehicle designs and data-driven route optimization are also helping reduce fuel consumption and emissions.

Environmental performance is increasingly influencing shipper decisions, turning sustainability into both a regulatory requirement and a competitive differentiator. Logistics providers that demonstrate measurable progress on emissions reduction are better positioned to secure long-term contracts with large industrial and retail clients.

Regional Growth Patterns

The pace and nature of growth vary by region. Asia Pacific leads global expansion, driven by rapid urbanization, industrial growth, and booming e-commerce markets. North America benefits from mature infrastructure, strong domestic manufacturing, and high levels of technology adoption. Europe, meanwhile, is advancing through harmonized regulations, cross-border integration, and sustainability-focused policies that are accelerating modernization across the sector.

A Defining Decade Ahead

As the global road freight market moves toward the USD 5 trillion mark by 2033, it is set to remain a cornerstone of international trade and economic activity. The next decade will be defined by the industry’s ability to balance volume growth, technological innovation, and environmental responsibility. Operators that successfully integrate digital intelligence with efficient and sustainable operations will be best positioned to capture value in an increasingly competitive global logistics landscape.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

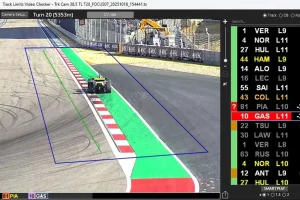

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,