California, Indiana, Missouri, Illinois, and Virginia will see increases in fuel taxes starting July 1st

Summer will not only bring an increase in temperatures. Starting from July 1st, California, Indiana, Missouri, Illinois, and Virginia will see relatively routine increases in fuel taxes take effect. According to reports, the states will experience an approximately 4-cent increase in the price per gallon.

Fuel tax increases

According to the CDTFA, in California, the diesel tax will increase from 44.1 cents to 45.4 cents per gallon, while the gasoline tax will rise to 59.6 cents from the current 57.9 cents per gallon. In Illinois, diesel taxes will reach 54.5 cents, while gasoline taxes will rise to 47 cents per gallon in a gradual increase set to occur between July 1st and June 30th, 2025.

In Indiana, the Department of Revenue announced that the gasoline tax will increase by only one cent per gallon, while the diesel and biodiesel tax will increase by two cents, reaching 59 cents per gallon. Similarly, in Missouri, a 3-cent increase in motor fuel taxes is expected, reaching 27 cents per gallon. This increase will be implemented gradually between July 1st and December 31st.

Meanwhile, in New Jersey, an initiative to annually increase fuel taxes and fees on electric vehicles has sparked controversy. The state plans to gradually increase fuel taxes by around 1.9 cents per year over the next five years, and establish an annual fee of $250 for electric vehicles, increasing by $10 each year for five years. This proposal has stirred discontent among stakeholders in New Jersey.

In Virginia, an increase in fuel taxes is anticipated. The diesel tax will increase from 30.8 to 31.8 cents per gallon, and the gasoline tax will rise from 29.8 to 30.8 cents. Additionally, taxes on blended diesel and gasoline will also increase by one cent, reaching 31.8 cents and 30.8 cents respectively.

However, Maryland is in a different situation. While other states will experience fuel tax increases, Maryland will see a reduction. According to the state comptroller’s office, starting July 1st, the gasoline tax will be 46.1 cents per gallon, compared to the current 47 cents, while diesel and biodiesel taxes will decrease to 46.85 cents per gallon from the current 47.75 cents.

Although these price increases have not yet been fully implemented and some will take effect gradually next month, comments and opposition have already emerged. Despite expectations of a continued decrease during the summer, these states will face increased costs in the near future, posing additional concerns and challenges for residents and businesses.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

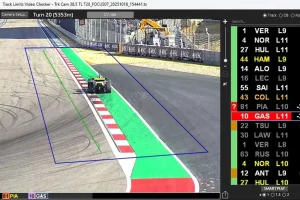

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,