President Donald Trump has doubled tariffs on imported steel and aluminum to 50%, reigniting his hardline trade agenda and raising alarms across U.S. industries. Economists warn the move, effective Wednesday, could drive up manufacturing costs and hit key sectors like commercial trucking and freight.

President Donald Trump has doubled tariffs on imported steel and aluminum to 50%, reigniting his hardline trade agenda and raising alarms across U.S. industries. Economists warn the move, effective Wednesday, could drive up manufacturing costs and hit key sectors like commercial trucking and freight.

A Renewed Tariff Strategy, Deeper Industrial Impact

The tariff hike marks a return to Trump’s aggressive trade stance reminiscent of his 2018–2019 strategy. Economists have warned that while those tariffs were intended to protect domestic producers, they also drove up input costs across the manufacturing sector.

Diane Swonk, chief economist at KPMG U.S., cited a Federal Reserve study noting that the earlier tariffs saved some jobs in the steel industry but resulted in an overall net loss in manufacturing employment. “Now double steel tariffs & combine them with more tariffs,” she posted, warning that the 2025 impact could be even more severe.

Sal Guatieri, senior economist at BMO, emphasized that the move could be a precursor to broader trade restrictions. “This could set a precedent for possibly higher duties on motor vehicles and other sector-specific products, such as lumber and microchips,” Guatieri said.

A Freight Sector Already Under Strain

The U.S. trucking industry — which forms the backbone of national supply chains — is particularly vulnerable to the effects of rising steel and aluminum prices. These materials are critical for manufacturing trucks, trailers, containers, and parts such as axles, frames, and fuel tanks.

Industry analysts say that higher metal prices could lead to increased costs for truck manufacturing and maintenance, just as fleets across the country are trying to modernize and meet stricter emission standards.

“Truck makers will likely pass these costs along, resulting in higher prices for new vehicles and delayed fleet replacements,” said a logistics economist with ties to a national freight association. “Increased overhead could also reduce capacity and push up freight rates”.

Additionally, disruptions in the automotive supply chain — particularly if vehicle or chip tariffs follow — would further stress freight carriers that rely on just-in-time deliveries.

Policy Uncertainty Clouds Investment Decisions

The trucking sector is also watching closely for potential ripple effects on consumer demand and industrial output. Tariffs that increase the price of construction materials, appliances, and autos could slow down sectors that generate significant freight volume.

“Uncertainty over long-term trade policy could discourage capital investment in trucking equipment, warehousing, and infrastructure,” said a transport industry consultant. “That’s a risk multiplier for a sector already grappling with labor shortages and high fuel costs.”

Divided Opinions on Trade Protections

Despite widespread criticism from economists, some pro-tariff groups have welcomed the administration’s decision. The Coalition for a Prosperous America called the tariff increase “timely” and said it demonstrated a commitment to protecting domestic steel and aluminum producers from subsidized foreign competition.

However, most experts warn that these protections come at a cost.

Looking Ahead

While federal courts have recently blocked and then reinstated portions of Trump’s broader tariff framework, the latest steel and aluminum duties appear secure — and potentially just the beginning.

With investigations into other sectors underway, the trucking industry could soon face a wave of compounded costs and regulatory pressures. The true weight of the new tariff policy, analysts suggest, will be measured not only in steel prices, but in how far the shockwaves travel across the U.S. economy’s most essential supply chain: its highways.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

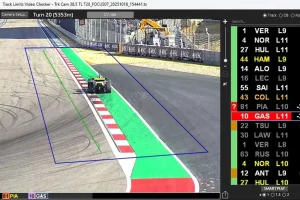

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,