The clash between President Donald Trump and Elon Musk has pushed Tesla to the edge: the stock plunged more than 14% in a single day, wiping out $153 billion in market value. As the fight escalates—politically, financially, and personally—markets are rattled and short-sellers are cashing in.

Tensions between U.S. President Donald Trump and entrepreneur Elon Musk are taking a toll on the markets. Tesla, the electric vehicle maker founded by Musk, saw its stock crash by 14.26% in a single session, erasing over $153 billion in market capitalization.

Meanwhile, short-sellers seized the moment: according to financial analytics firm S3 Partners, they earned more than $4 billion by betting against the company as its stock tanked.

The feud erupted after a series of sharp public statements. Musk called Trump’s proposed tax reform—branded the “Big, Beautiful Bill”—a “disgusting abomination.” The legislation is still awaiting Senate approval after passing the House of Representatives. Trump quickly fired back, threatening to revoke federal subsidies and cancel government contracts with Musk-owned companies, including SpaceX, a key NASA contractor.

Tensions escalated further amid rumors connecting both figures to the Epstein case, and incendiary remarks from Trump ally Steve Bannon, who even called for Musk to be deported “immediately.”

Tesla in Freefall

Tesla’s stock had already been under pressure due to weak Q1 earnings. The company reported a 71% drop in net profit, posting just $409 million compared to $1.4 billion a year earlier. Auto sales dropped 13%, pulling down revenue and causing EBITDA to fall 17%.

Against this backdrop, the Trump feud acted as a major trigger for the market collapse—what analysts describe as a Musk-driven reaction.

“Tesla has always traded with Musk. When he’s seen as a visionary, the stock climbs. When he turns into a lightning rod for controversy, it crashes,” said Wayne Kaufman, Chief Market Analyst at Phoenix Financial Services, in an interview with Bloomberg.

Risks for the U.S. and the Future of Tech

The feud is also raising alarms over the potential structural impact on the U.S. tech industry. From SpaceX satellites to Grok AI software to Tesla’s EV dominance, Musk’s companies are seen as strategic national assets.

“Targeting Musk’s companies could put America’s technological leadership at risk,” warned Tom Orlik, Chief Economist at Bloomberg Economics.

For Adán Sarhan, CEO of 50 Park Investments, the conflict is quickly morphing into a “battle of egos” with global implications. “These are two of the most powerful figures on the planet. And if it comes down to a showdown, Trump won’t allow himself to lose publicly. The impact on Tesla could be immeasurable,” he said.

Following Thursday’s close, Tesla shares rebounded 5% in after-hours trading, though the stock remains far below its all-time high from December. Since then, Tesla has lost over 40% of its value.

The Trump-Musk battle shows no sign of slowing—and it may ultimately reshape not only Tesla’s market trajectory but the balance between political and corporate power in the United States.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

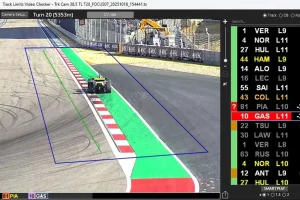

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,