A Tax Foundation's analysis revealed a list of states and their fuel taxes

California, Illinois, and Pennsylvania lead as the states with the highest diesel and gasoline taxes, according to a new fuel analysis by the Tax Foundation. The study, published on August 6, evaluated state fuel tax rates as of January 2024.

In 2024, diesel tax rates, which have increased similarly to gasoline rates, are not offsetting the rise in road construction and maintenance costs. This suggests that a significant change in current policies might be necessary. States impose fuel taxes in various ways, such as sales taxes, excise taxes per gallon, and other wholesale or retail taxes, which are generally passed on to consumers. These additional taxes and fees contribute to the price consumers pay at the pump.

California: the state with the highest fuel tax

The Tax Foundation’s analysis revealed a list of states and their fuel taxes, highlighting California as the state with the highest fuel taxes in the U.S.. According to the report, California adds 68.1 cents to the price of a gallon of gasoline and 96.3 cents to the price of a gallon of diesel.

The report indicates that California leads in fuel taxes, with an additional impact of approximately 12 cents per gallon due to the Low Carbon Fuel Standard and 27 cents from the cap-and-trade program. These rates significantly exceed the EIA’s average state tax rates, which are 32.44 cents per gallon for gasoline and 34.74 cents for diesel.

The Tax Foundation reported that Alaska, Mississippi, and Hawaii have the lowest per-gallon taxes for both gasoline and diesel. However, these figures do not account for the impact of environmental policies such as low carbon fuel standards and emission trading programs, which increase prices in states like California, Washington, and some Northeastern states.

States with the highest fuel taxes in the U.S.

- California – $0.963

- Pennsylvania – $0.741

- Illinois – $0.740

- Indiana – $0.580

- Michigan – $0.535

- Washington – $0.528

- New Jersey – $0.494

- Connecticut – $0.492

- Maryland – $0.479

- Ohio – $0.470

The foundation noted that calculating the exact impact of these carbon taxes is complex due to varied estimates. For example, environmental agencies often report lower impacts than other economic analyses, and prices can fluctuate due to the variability in programs like cap-and-trade.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

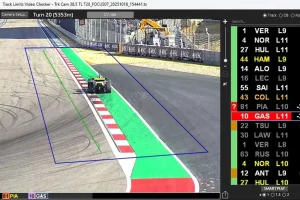

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,