Trump’s No-Tax-On-Overtime proposal aims to provide financial relief to workers by reducing their tax burden on overtime pay, tips, and Social Security benefits.

Donald Trump’s proposal to eliminate federal taxes on overtime pay, tips, and Social Security benefits is designed to increase workers’ take-home pay and stimulate economic growth.

Background

During the 2024 presidential campaign, Donald Trump pledged to remove federal taxes on tips earned by workers in service industries, such as restaurant servers, bartenders, and valets. His opponent, Kamala Harris, also supported this initiative for hospitality workers. A version of Trump’s proposal was included in the official 2024 Republican platform, advocating for a tax exemption on tips for millions of workers in the restaurant and hospitality sectors. Trump reaffirmed his commitment to this policy in January 2025, promising that workers’ tips would be entirely theirs, regardless of their profession.

Key Aspects of the Proposal

- Overtime Pay: Exempting overtime earnings from income tax would allow workers to keep more of their wages, increasing disposable income and potentially boosting economic activity.

- Tips: Eliminating taxes on tips would significantly benefit service industry workers, including restaurant staff, delivery drivers, and gig workers, who rely on gratuities as a substantial part of their earnings.

- Social Security Benefits: Making Social Security benefits tax-free would provide retirees with more financial security, improving their quality of life and increasing consumer spending in local economies.

Understanding Tip Taxes

Under current U.S. tax laws, tips of $20 or more per month from a single job are treated as taxable wages subject to withholding. This includes cash tips received directly from customers, tips added to credit and debit card payments, and distributed tips from a tip-sharing system.

Employees must maintain a daily record of their tip earnings and report them to their employer, who is responsible for withholding income taxes, as well as Social Security and Medicare (FICA) taxes, based on both wages and reported tips. Employers must also contribute their share of FICA taxes on the total earnings of the employee, including tips.

Mixed reactions

The proposal has received mixed reactions from industry professionals, labor advocates, and economists.

Ryan Hughes-Svab, co-owner of The Misfit Lou restaurant and bar, told USA Today:

“I think it could help a lot of people. But I also see potential downsides. There’s a tipping culture in the U.S., and some large companies might exploit this by lowering base wages and relying more on tips to compensate workers.”

Ted Pappageorge, secretary-treasurer of the Culinary Union, emphasized the need for broader labor reforms, stating:

“Eliminating taxes on tips should be part of a larger plan to address the high cost of living for working families. This includes ending the $2.13 sub-minimum wage for tipped workers and tackling corporate price gouging in food, gas, and housing.”

Additionally, Representative Steven Horsford has introduced legislation to eliminate the federal income tax on tips while also pushing for the abolition of the sub-minimum wage for tipped employees. He argues that these measures would benefit millions of low-income workers across the country, particularly in states like Nevada.

Trump’s No-Tax-On-Overtime proposal aims to provide financial relief to workers by reducing their tax burden on overtime pay, tips, and Social Security benefits.

While supporters view it as a way to increase workers’ earnings and stimulate the economy, critics warn of potential unintended consequences, such as shifts in employer pay structures and economic imbalances in certain industries. As the debate continues, the impact of these proposed tax changes remains a key issue in discussions on labor policy and economic growth.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

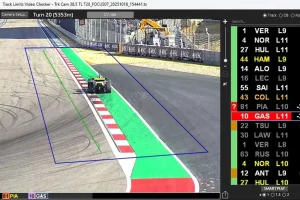

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,