The changes in tariffs on Mexico, Canada, and China represent the largest restructuring of crude and fuel trade flows.

Tariffs on Mexico, Canada, and China began to be applied starting yesterday, Tuesday, March 4. One of the main concerns for consumers is the impact these tariffs could have on fuel prices across the United States, as the global supply of oil and fuels will need to adjust due to this new imposition.

On one hand, crude oil from Mexico, which supplies U.S. refineries in the Gulf, will be diverted, making way for Latin American oil types that are tariff-free, such as Brazilian oil, along with potential increases in supplies from the Middle East. Meanwhile, fuel buyers on the U.S. East Coast will have to turn to European refineries to supply some of the shipments that would normally come from Canada, as reported by TransportTopics.

Restructuring of fuel trade flows

The changes in tariffs on Mexico, Canada, and China represent the largest restructuring of crude and fuel trade flows since Russia’s invasion of Ukraine, which will impact global markets. Gasoline prices are expected to increase differently across the various regions of the U.S., with northeastern residents being the most affected, potentially seeing a rise of between 20 and 40 cents by mid-March. Additionally, operators are anticipating further market turmoil, paying premiums for bearish Brent options while speculating on fuel price increases in the country.

Despite the U.S. being the world’s leading oil producer, imports remain crucial for its energy supply, especially crude oil from Canada and Mexico, which together account for more than two-thirds of the imports to U.S. refineries.

What is clear is that the new tariffs, which impose a 10% levy on Canadian imports and a 25% levy on those from Mexico, will increase inflation in the U.S., affecting consumer confidence, according to experts from the consulting firm Rystad Energy.

Fuel price increase across the U.S.

U.S. refineries are highly likely to be affected by the rise in oil costs, which will impact consumers, leading to higher fuel prices. Although Canadian imports may be less affected due to the tariff being only 10%, prices for Western Canadian Select (WCS) oil fell on March 4 due to uncertainty about the demand for these shipments.

On the other hand, some fuel supplies from Canada, which would typically be sent to the U.S., will no longer be profitable due to the tariffs and will be redirected to Europe. Additionally, markets for sulfurous barrels and high-sulfur fuel oil will also be impacted, as tariffs on Mexico and Canada will make shipping these supplies to the U.S. prohibitively expensive, potentially diverting about 260,000 barrels per day to Europe.

Finally, Mexican oil exports to the U.S. will also be affected by the 25% tariff. This will make Gulf Coast refineries less competitive due to the increase in the raw material cost, forcing them to seek heavy barrels from other regions, further disrupting crude trade flows in the area, according to a recent article published by Transport Topics.

Despite the uncertainty, experts assure that, while tariffs are expected to increase prices, they do not anticipate that prices will reach the levels seen in 2022, when the national average gasoline price hit $5 per gallon.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

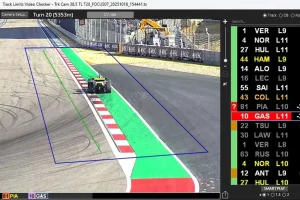

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,