Cross-border freight among the United States, Canada, and Mexico reached $131 billion, a 2.4% year-over-year drop that underscores uneven performance across the continent’s main trade corridors.

In June 2025, cross-border freight between the United States, Canada, and Mexico totaled $131 billion, marking a decline of 2.4% compared to the previous year. The data highlights diverging trends across the continent’s major trade corridors.

Trade with Canada fell 9.7%, amounting to $58.1 billion, while trade with Mexico rose 4.4%, reaching $73 billion. This sharp contrast underscores Mexico’s growing role as the United States’ top land trade partner, powered by robust supply chains in the technology and automotive sectors. Canada, meanwhile, is seeing contractions across multiple industrial areas.

Freight by Mode: Air Cargo Surges, Rail and Pipelines Weaken

BTS data reveals significant variation across transportation modes in June 2025:

- Trucks: $84.9 billion (down 2.4%)

- Rail: $15.4 billion (down 11.9%, the steepest decline among land modes)

- Maritime: $10 billion (down 4.4%)

- Pipelines: $7.9 billion (down 11.6%)

- Air: $5 billion (up 8.5%)

Air cargo stood out as the only growing mode, boosted by shipments of high-value goods such as electronics, machinery, and pharmaceuticals. In contrast, land and energy transport struggled amid shifting market conditions.

Key Border Crossings: Laredo Leads North America

The BTS report also identifies the busiest freight gateways:

- S.–Canada: Detroit, Port Huron, and Buffalo lead in trucking; Detroit, Port Huron, and International Falls dominate rail; Chicago, Port Huron, and Minneapolis are central for pipelines; Boston, Arthur, and Portland stand out for maritime energy flows.

- S.–Mexico: Laredo, Texas, tops the list with $24.7 billion in truck trade, followed by El Paso–Ysleta ($9.5 billion) and Otay Mesa, California ($4.7 billion). On rail, Laredo ($4 billion), Eagle Pass ($2.9 billion), and Nogales ($700 million) are key. Houston, Arthur, and Texas City anchor energy trade by sea.

These figures confirm the strategic dominance of the southern border—especially Laredo—as the top trade gateway in North America.

Top Commodities: Electronics, Vehicles, and Energy

The most-traded goods in June 2025 included:

- S.–Canada: Computers and parts ($5.6 billion), vehicles and auto parts ($3.7 billion), electrical machinery ($2.3 billion).

- S.–Mexico: Computers and parts ($15.5 billion), electrical machinery ($11.2 billion), vehicles and auto parts ($6.9 billion).

Rail shipments remained dominated by vehicles, supplemented by mineral fuels and plastics with Canada, and computing machinery with Mexico.

Outlook: Opportunities and Challenges

The BTS emphasized that all figures are in current U.S. dollars, not adjusted for inflation or seasonality, and subject to revision. The next report, covering July 2025, will be released on September 24, 2025.

The current trade picture reveals:

- Mexico’s rising momentum in U.S. trade, fueled by tech and auto supply chains.

- Canada’s slowdown in critical industries.

- Air freight’s resilience, contrasting with rail, pipelines, and maritime declines.

The 2.4% drop in cross-border freight trade in June 2025 presents both challenges and opportunities for North America. While the downturn highlights vulnerabilities in energy and land transport, it also underscores the potential of air cargo and Mexico’s growing role as a logistics hub.

With computers, vehicles, and electrical machinery leading the flow of goods, the region’s competitiveness will depend on infrastructure investment, streamlined border operations, and adaptability to global trade shifts.

.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

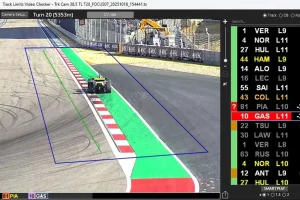

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,