The Trump administration recently announced its intention to impose a 25% tariff on heavy trucks manufactured outside the United States.

The Trump administration recently announced its intention to impose a 25% tariff on heavy trucks manufactured outside the United States, a measure set to take effect on October 1, 2025. As explained in a post on his Truth Social platform on September 25, the goal is to protect American manufacturers from what he described as unfair foreign competition, thereby strengthening the national industry not only economically but also in terms of security.

In April, the Department of Commerce launched an investigation to assess the potential national security impacts of truck imports. Although Trump’s announcement did not specify which classes of trucks would be affected, this earlier investigation provides some context, suggesting that the tariffs could cover a wide range of vehicles and components within the sector.

A contradiction arises when considering that manufacturers like Peterbilt, Mack Trucks, Freightliner, and Kenworth manufacture both inside and outside the United States, which could result in mixed consequences for the very companies the measure aims to protect. While the intention is to limit the entry of foreign-manufactured trucks, these companies could face complications in their international operations or in sourcing parts produced abroad.

ATA opposes tariff increase on heavy trucks

The legal basis for this measure lies in Section 232 of the Trade Expansion Act of 1962, which grants the government authority to impose tariffs if certain imports are found to pose a threat to national security. However, the trucking industry has openly voiced its opposition.

The American Trucking Associations (ATA) has expressed its rejection of the tariffs since the possibility was first raised. In May, the organization shared concerns over the potential economic repercussions, warning that the measure could further weaken a sector already facing a complex operating environment. According to statements reported by Transport Topics, the ATA stated that there is no evidence that heavy truck imports pose a real threat to national security.

From the ATA’s perspective, imposing tariffs on trucks manufactured in Mexico would be particularly problematic. The association emphasized that truck production in North America is highly integrated, and that restricting imports from a neighboring and trade-partner country like Mexico could be counterproductive. They also highlighted that the trucking industry is extremely competitive and operates on very narrow profit margins, limiting its ability to absorb additional costs.

Finally, the ATA warned that a 25% tariff would significantly increase the price of a new truck. A Class 8 vehicle, which currently costs an average of $170,000, could rise to $224,000 due to the combined impact of the tariff and federal tax. According to the association, this price hike would be unaffordable for most fleets, forcing them to extend the usage cycles of their current trucks. This would, in turn, affect both new vehicle production and parts manufacturing, negatively impacting the broader North American economy.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

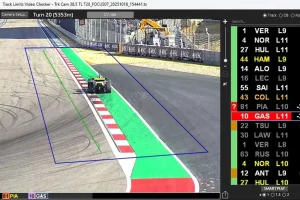

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,

All content and original artwork, unless otherwise noted, is protected by copyright. Saint George uses certain images under license from various licensing vendors for this purpose. Any unauthorized commercial reproduction or distribution of copyrighted materials is prohibited.