The cancellation of 13 Mexican airline routes has raised concerns that U.S. regulators may soon tighten oversight in cross-border trucking, reshaping the logistics landscape between both countries.

America First at the Border

The U.S. government’s recent decision to cancel thirteen routes operated by Mexican airlines has made clear that the current administration is prepared to assert a firmer stance on trade and transportation policy. Officials stated that Mexico has failed to uphold its obligations under the bilateral aviation framework, granting advantages to domestic carriers while limiting the operating conditions of U.S. companies. While the immediate impact is within the aviation sector, analysts warn that the consequences could extend directly into the world of cross-border trucking, where the majority of physical trade between the two countries takes place.

Why Trucking Is Now Part of the Conversation

More than eighty-five percent of U.S.–Mexico trade moves by truck. Every day, commercial traffic flows through Laredo, El Paso, Otay Mesa, Nogales, Pharr and Brownsville, enabling supply chains for automotive, manufacturing, agriculture and energy sectors. For this reason, anything that affects the balance of transportation policy between both nations carries immediate implications for the trucking industry.

The cancellation of air routes is widely being interpreted as a strategic message. It is a signal that the United States will not accept uneven competition or inconsistent regulatory environments. If reciprocity is not restored in aviation, pressure could shift toward freight carriers, customs procedures and operating permits for Mexican trucking companies entering the U.S. market. Even minor administrative measures, such as slower inspection processing or temporary permit reviews, could significantly affect border waiting times, freight delivery schedules and cost structures.

Historical Memory: The 2009–2011 Trucking Dispute

The trucking sector remembers the last time transportation became leverage in diplomatic negotiations. Between 2009 and 2011, the United States restricted long-haul operating authority for Mexican trucks. Mexico responded with targeted tariffs affecting U.S. agricultural and industrial exports. The dispute hurt businesses on both sides of the border and was only resolved when a new pilot program was put in place.

The lesson remains relevant: disputes in one transportation sector rarely stay contained there. Aviation rules, trucking access, customs procedures and tariff decisions are interconnected within the broader sphere of bilateral trade relations.

A Question of Fairness and National Interest

Supporters of the current U.S. decision frame the issue as one of economic fairness and national interest. They argue that American carriers should not be required to compete under conditions that are more restrictive than those applied to their Mexican counterparts. Under this view, America First is not about isolation but about defending the integrity of domestic industries and ensuring a level playing field.

From this perspective, strong borders do not mean closed borders. They mean fair and reciprocal borders, where U.S. companies do not face additional compliance burdens or operational disadvantages.

What Could Happen Next

If Mexico and the United States find a mutually acceptable adjustment to the aviation dispute, the trucking sector may see minimal disruption. However, if the disagreement widens, several scenarios are possible. Border inspections could gradually become slower. Long-haul operating permissions for Mexican carriers could be reviewed. Additional scrutiny from customs and transportation agencies could emerge, particularly at high-volume ports of entry. Even without explicit policy changes, a shift toward caution at the inspection level would be enough to reshape daily freight operations.

For companies moving time-sensitive goods, such as automotive components, refrigerated products, or just-in-time manufacturing freight, even moderate slowdowns can have cascading effects on cost and reliability.

The cancellation of Mexican airline routes is not simply a regulatory adjustment. It is a message that the United States intends to enforce reciprocity in transportation and trade relations. And given the central role of trucking in U.S.–Mexico commerce, the next stage of this dispute could unfold at the border itself.

For now, carriers, logistics companies and supply chain managers should prepare for the possibility of longer inspection times, higher compliance expectations and a more assertive U.S. regulatory posture. The border remains open — but it is also being watched more closely.

America First at the border means the rules must be fair on both sides.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

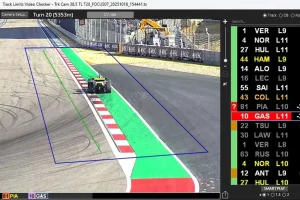

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,