Despite the storm's impact, Florida's insurance sector has started 2024 in a stronger financial position

During the 2024 tropical storm season, Florida’s insurance sector has demonstrated a notable capacity for adaptation and preparedness, aiming to protect its financial balances and provide more robust coverage. According to a report by the KBRA agency, recent regulatory reforms and significant increases in insurance rates have incentivized reinsurers to actively participate in the market.

The addition of greater reinsurance capacity has allowed insurers to acquire larger coverage towers, improve protection for multiple events, and adjust retention levels. This strategic adjustment has been crucial in addressing the financial challenges posed by adverse weather events.

As of Wednesday, insured losses from Hurricane Debby were estimated at $113.8 million, with 15,326 claims filed, 9,416 of which affect residential properties. Reported damages also included vehicles and commercial properties. Debby made landfall on August 5 in Taylor County and then moved northward through Florida and Georgia.

Is Florida’s insurance sector prepared for the impact of the storm season?

Despite the storm’s impact, Florida’s homeowners’ insurance sector has started 2024 in a stronger financial position, following a relatively calm storm season in 2023. Most insurers reported a significant improvement in their financial results and balance sheets by the end of last year. KBRA highlighted that the average surplus for homeowners’ insurers in Florida increased by 29% year-over-year, driven by better underwriting results.

The reduction in loss ratios (excluding catastrophe losses) has been notable, with frequencies well below 50%. This positive trend has led KBRA to project continued growth in the sector’s capital base, although price pressures and new business volumes will remain crucial factors.

The increased participation of reinsurers and expanded capacity reserves reflect a more favorable environment compared to previous years. However, future stability in reinsurance prices will depend on activity during the storm season and the final performance of programs this year.

Despite the preparation and improved capital positions, KBRA warns that an active storm season could present significant challenges, especially for new entrants with modest surplus bases or high geographic exposure concentrations.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

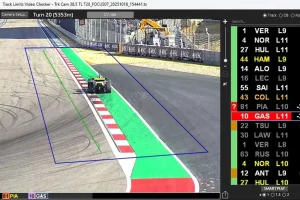

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,