Fall deadlines apply to additional states; special relief available for those affected by terrorist attacks in Israel.

The Internal Revenue Service (IRS) is reminding individuals and businesses in areas covered by federal disaster declarations in 2024 that they have until Thursday, May 1, 2025, to file their federal income tax returns and make tax payments for the 2024 tax year. Taxpayers in three additional states face extended deadlines into the fall.

When the Federal Emergency Management Agency (FEMA) designates a disaster area, the IRS typically provides automatic relief—postponing various filing and payment deadlines. Taxpayers with a registered address in one of these areas do not need to apply for the extension; it is granted automatically.

The most up-to-date list of eligible localities is available on the IRS website’s Tax Relief in Disaster Situations page.

Who qualifies for the May 1, 2025 deadline?

Taxpayers in the following areas qualify for the extended May 1, 2025, deadline:

Entire states: Alabama, Florida, Georgia, North Carolina, South Carolina

Alaska: City and Borough of Juneau

New Mexico: Chaves County

Tennessee: Carter, Claiborne, Cocke, Grainger, Greene, Hamblen, Hancock, Hawkins, Jefferson, Johnson, Sevier, Sullivan, Unicoi, and Washington counties

Virginia: Numerous counties and cities, including Roanoke, Montgomery, Norton, Bristol, and Radford, among others

Additional Tax Filing Extensions Available

Taxpayers who need more time beyond the May 1, 2025 deadline to file (but not to pay) can request an additional extension. The IRS encourages electronic filing of these requests by April 15, 2025.

Disaster-area taxpayers may also request an extension between April 15 and May 1, but these requests must be submitted on paper using Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Whether submitted electronically or by paper, this extension provides time to file until October 15, 2025, while tax payments remain due by May 1, 2025.

Other Disaster-Area Deadlines

Taxpayers in the following areas have fall deadlines to file and pay:

October 15, 2025: Los Angeles County, California (January 2024 wildfires)

November 3, 2025: All of Kentucky and the counties of Boone, Greenbrier, Lincoln, Logan, McDowell, Mercer, Mingo, Monroe, Raleigh, Summers, Wayne, and Wyoming in West Virginia

Special Relief for Taxpayers Affected by Attacks in Israel

The IRS has also extended deadlines for taxpayers impacted by the October 7, 2023 terrorist attacks in Israel. Individuals and businesses in Israel, Gaza, the West Bank, and other affected persons have until September 30, 2025, to file and pay most taxes due from October 7, 2023, through September 30, 2025. This includes returns in the 1040 and 1120 series.

What Returns and Payments Qualify for Automatic Extension?

The following are among the returns and payments eligible for the automatic extension:

2024 calendar-year partnership and S Corporation returns (normally due March 17)

2024 individual income tax returns and payments (normally due April 15)

April 15 estimated tax payments

2024 calendar-year corporate and fiduciary income tax returns and payments (normally due April 15)

Other time-sensitive tax-related actions

For full details, visit the IRS Disaster Assistance page.

Penalty Relief and Special Circumstances

The IRS automatically waives penalties for late filing or payment for taxpayers in disaster areas. If an affected taxpayer receives a penalty notice with a due date within the extended period, they should call the number listed on the notice to have it removed.

The IRS also works with those outside the disaster area if their necessary tax records are located in an affected region. These individuals—along with relief workers affiliated with recognized government or nonprofit organizations—can call 866-562-5227 to request assistance.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

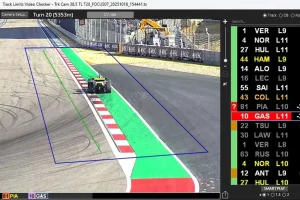

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,