The United States Federal Reserve decided to keep interest rates unchanged, in line with market expectations.

In the latest episode of the Mercado Sobre Ruedas podcast, financial markets journalist Julián Yosovitch analyzes the current stance of the U.S. Federal Reserve (Fed) and the performance of the American economy, in a context marked by persistent inflation. Below, we review his main takeaways.

The Federal Reserve of the United States decided to keep the interest rate unchanged within the range of 3.50% to 3.75%, in line with market expectations, thus bringing to an end a streak of three consecutive 25–basis-point cuts. The decision reflects a more balanced view of macroeconomic risks and greater caution in the face of persistent inflation.

In its statement, the Fed removed the clause that warned that the risk of a weakening labor market was greater than that of inflation. With this change, the Fed indicated that it now perceives more moderate risks and greater stability in both employment and economic activity, reducing the urgency for further rate cuts.

According to the central bank, available indicators suggest that economic activity continues to expand at a solid pace, job growth has moderated, and the unemployment rate shows signs of stabilization. However, the monetary authority warned that inflation remains elevated relative to its 2% target, as the PCE index stands near 2.8%, closer to 3% than to the official goal.

Interest rates, markets, and inflation

The vote to maintain interest rates was not unanimous. Two governors, Stephen Miran and Christopher Waller, voted against keeping rates unchanged and advocated for another 25–basis-point cut. Both officials were nominated by former President Donald Trump, who has intensified political pressure on the Fed to lower borrowing costs and stimulate economic growth. In contrast, the other 10 members of the committee supported the decision to keep monetary policy unchanged.

Following the announcement, Fed Chair Jerome Powell said that recent data show an improvement in growth prospects, inflation evolving broadly as expected, and signs of stabilization in the labor market. Powell stated that the current stance of monetary policy is appropriate to address the challenges facing the U.S. economy and, for now, ruled out a rate hike, while emphasizing that future decisions will be assessed meeting by meeting.

In financial markets, expectations for rate cuts remained largely unchanged. Investors currently assign a 47% probability to a first rate cut in June, while for the March and April meetings the Fed is expected to keep rates unchanged. A second cut could occur toward the final quarter of the year, with a probability close to 33%.

The macroeconomic backdrop supports the Fed’s cautious approach. The U.S. economy posted robust growth, with annualized GDP expanding 4.4%, driven mainly by private consumption, which grew 3.5%, and by strong export performance. Inflation, while still elevated, has not shown a de-anchoring of expectations, and the labor market remains resilient despite a slowdown in job creation.

Meanwhile, the weakness of the dollar has deepened. Over the past year, the U.S. currency fell more than 10% against other currencies, boosting a strong appreciation of emerging market currencies such as the Mexican peso, the Brazilian real, and the Chilean peso. This trend also strongly supported precious metals: silver rose 256% and gold 89% against the dollar over the past year.

Global outlook: emerging markets

The global landscape shows a markedly stronger performance by emerging markets, particularly in Latin America, where stock exchanges such as Peru and Chile led gains, far outperforming major U.S. indices. Nevertheless, sources of volatility persist, linked to domestic political tensions in the United States, the geopolitical environment, and movements in Japan’s debt markets.

Thus, the Fed continues to pursue a delicate balancing act: sustaining economic growth without reigniting inflationary pressures, in an economic environment that, for now, does not justify further interest rate cuts.

Super Bowl LX: The Logistics Behind the Patriots–Seahawks Showdown

Super Bowl LX, featuring the New England Patriots and the Seattle Seahawks, is far more than the NFL’s championship game. It involves one of the most complex logistics operations in the world, with hundreds of trucks, ultra-precise technical production, layered security controls, and an industrial-scale deployment that turns Levi’s Stadium into a temporary city for 72 hours.

Job cuts surge in January, weighing on transportation

January saw one of the largest waves of job cuts since 2009 across multiple sectors in the United States. January saw one of the largest

Federal Reserve: rates remain unchanged with caution amid a solid economy

The United States Federal Reserve decided to keep interest rates unchanged, in line with market expectations. In the latest episode of the Mercado Sobre Ruedas

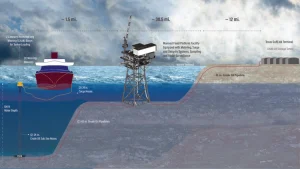

DOT Grants Historic License for Deepwater Oil Export Port

The license issued by the U.S. Department of Transportation (DOT) to the Texas GulfLink project strengthens America’s energy export infrastructure and signals new growth for industrial logistics and heavy-duty trucking.

What Truck Drivers Love Most About Their Job

Truck driving isn’t just a job; for many, it’s a calling that offers a unique blend of freedom, adventure, and independence. By Bob Dilliplaine, Industry

Frozen Roads After Bomb Cyclone: Black Ice, Record Snow and High Risk for Trucks

Frozen roads continue to disrupt freight transportation following the impact of a powerful bomb cyclone, leaving behind black ice, highway shutdowns, power outages, and dangerous winter driving conditions stretching from the Gulf Coast to New England.