STAA compliance is no longer a technical detail for fleet owners—it is a financial, legal, and insurance exposure. A recent enforcement action in Texas shows how mishandling safety complaints can lead to termination claims, retaliation findings, and six-figure penalties, and what carriers must do to avoid becoming the next case.

In today’s trucking industry, safety is not just an operational concern—it is a legally protected activity. And when safety complaints are handled incorrectly, the consequences can be far more serious than a delayed load or a frustrated dispatcher. A recent federal enforcement action in Texas demonstrated this reality with unusual clarity: a commercial driver was terminated after raising safety concerns, and the company was ultimately ordered to reinstate him and pay more than $100,000 in damages.

This case was not about labor politics. It was about STAA compliance—and the costly risks that arise when fleet owners misunderstand what the law actually requires.

What happened—and why it matters

According to the U.S. Department of Labor, the Texas-based carrier dismissed a commercial driver shortly after he raised concerns related to safety conditions. Federal investigators concluded that the termination constituted retaliation under the Surface Transportation Assistance Act (STAA).

The penalty was significant. The company was ordered to reinstate the driver and pay back wages, interest, compensatory damages, and punitive damages. The total exceeded six figures.

What makes this case particularly relevant for fleet owners is that the decision did not depend on whether every technical detail of the driver’s complaint was ultimately proven correct. Under STAA standards, what matters is whether the concern was reasonable and whether the employer responded with an adverse action.

That distinction is critical—and often misunderstood.

What STAA actually protects

The Surface Transportation Assistance Act, codified at 49 U.S.C. §31105, is a whistleblower protection statute specific to commercial motor vehicle safety. It applies to:

Truck drivers, including independent contractors when personally operating CMVs

Mechanics

Freight handlers

Any worker whose job directly affects CMV safety

Under the statute, an employer may not discharge, discipline, or discriminate against an employee because the employee:

Filed or attempted to file a safety complaint

Reported a violation of CMV safety regulations

Refused to operate a vehicle due to unsafe conditions

Accurately reported hours of service

Cooperated with a safety or security investigation

Provided information related to a crash or safety incident

The law also protects employees when the employer merely believes the employee is about to report a violation.

This is where many carriers get into trouble. Retaliation does not have to be explicit. It can include schedule changes, pay reductions, demotions, harassment, or changes in job conditions.

Why this is an insurance and liability issue

From a risk perspective, STAA violations are not simple HR disputes. They are high-severity exposure events.

The law allows for:

Mandatory reinstatement

Back pay with interest

Attorney’s fees

Expert witness fees

Compensatory damages

Punitive damages of up to $250,000

And critically, these protections cannot be waived through contracts, policies, or onboarding documents.

For insurers, this translates into increased claim severity. For fleet owners, it means that mishandling a single complaint can trigger a loss far greater than most equipment failures or cargo disputes.

Where most fleets go wrong

Most STAA violations do not originate with company executives. They start with supervisors, dispatchers, or operations managers reacting emotionally to a perceived problem.

When a driver is viewed as “difficult,” “slowing things down,” or “hurting productivity,” the response often becomes personal. That is exactly what the STAA was designed to prevent.

The law does not evaluate intent. It evaluates outcomes.

How to reduce STAA exposure

1. Create formal reporting channels

Drivers must know where safety issues go, how they are logged, and how they will be addressed. When no formal system exists, complaints become personal conflicts.

That is when retaliation risk increases.

2. Train supervisors and dispatchers

Frontline managers must understand what STAA protects and what qualifies as retaliation. Most violations are not malicious; they are uninformed.

Training should emphasize that safety complaints are not disciplinary issues.

3. Document every complaint

Each safety concern should be recorded, reviewed, investigated, and resolved in writing. Documentation is the strongest legal defense a carrier has.

If it is not documented, it did not happen, at least in court.

4. Treat maintenance complaints as regulatory warnings

Brake issues, tire failures, unstable loads, and mechanical defects are not “preferences.” They are potential federal violations.

Ignoring them creates accident exposure, regulatory exposure, and STAA exposure.

5. Never pressure drivers on hours

Hours-of-service falsification is one of the most common STAA claims and one of the easiest to prove. With ELDs, GPS, toll logs, and weigh station data, these cases rarely stay hidden.

6. Put non-retaliation policies in writing

This is not just good practice. It is legal insulation.

Policies should explicitly state that safety complaints are protected and that refusal to operate unsafe equipment will not result in discipline.

A necessary mindset shift

For decades, many carriers treated safety complaints as operational disruptions. That approach is now legally obsolete.

Today, safety complaints are legally protected acts.

The STAA was designed to prevent crashes, fatalities, and cover-ups. From a business standpoint, it exists to prevent catastrophic losses.

This is not about favoring employees. It is about preventing enforcement actions, lawsuits, reputational damage, and insurance losses.

Final takeaway for fleet owners

The Texas case is not unique. It reflects a broader enforcement trend.

Regulators no longer ask whether a company meant to retaliate. They ask whether it did.

And that distinction can cost or save six figures.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

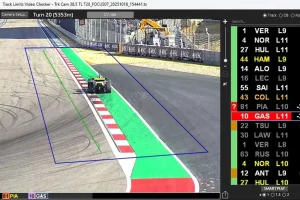

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,