Failure to meet taxes obligation can result in various penalties, staying informed can make a difference

Filing taxes can be a tedious task, but it’s crucial to fulfill tax obligations to avoid consequences. Self-employed truck drivers, in addition to their many responsibilities, must file their annual tax return to avoid financial and legal issues that could affect their careers on the road.

Failure to meet this obligation can result in various penalties. Below, we’ll examine the consequences of not paying taxes and why truck drivers should take this responsibility more seriously.

The importance of paying taxes

The Internal Revenue Service (IRS) is a vital entity in the United States, responsible for managing and enforcing federal tax laws. Acting as the guardian of tax obligations, its primary function is to ensure that both citizens and businesses meet their financial responsibilities to the U.S. government.

This entity is also responsible for imposing penalties and charges in case of delay or failure to file tax returns. For truck drivers, as well as for other U.S. citizens, these penalties can accumulate, resulting in increased financial burden. The IRS imposes a penalty of 5% of the unpaid taxes for each month of delay in filing tax returns, in addition to the potential loss of refunds and tax deductions, such as truck expenses, fuel, maintenance, and insurance.

Moreover, long-term non-compliance can result in wage garnishments, bank account levies, property seizures, charges for tax evasion, or even passport revocation. This can damage the truck driver’s reputation and business relationships, leading to the loss of contracts and job opportunities. How can truck drivers avoid this situation?

The tax payment process can be confusing, but there are professionals who provide the support and tools needed to make it more manageable. Once the truck driver decides to be proactive and take action regarding their tax responsibilities, it’s advisable to seek help from a qualified tax professional or accountant who understands the trucking industry. With guidance on how to gather the necessary documentation, manage various tax laws, and develop a strategy to meet filing requirements, dealing with the IRS will be less complicated.

But the work doesn’t end there; tax filing must be maintained, especially for self-employed truck drivers. Taking responsibility and dedicating the necessary time and effort to track income and expenses throughout the year, setting aside funds for tax payments, and staying informed about changes in tax laws will help avoid financial or legal problems.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

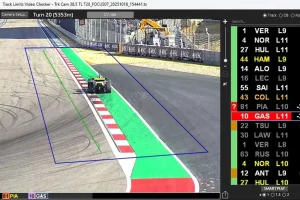

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,