Taking out insurance reduces the direct financial burden on the insured's pocket and is an essential back-up for the insured

In most states, it is mandatory to have commercial coverage for company vehicles. This legal requirement highlights the importance of protecting vehicles used in business activities, such as transporting goods, equipment, or passengers. A company committed to its clients can provide smart solutions for insurance, registrations, and road transport permits.

Since 1999, Saint George Insurance Brokerage Inc. has been dedicated to offering the best care and service to its clients. We understand the importance of having insurance that covers all your needs. We offer a wide range of insurance options, including workers’ compensation, life insurance, vehicle coverage, home insurance, and business insurance. It all begins with a call from our agents.

The importance of insurance and how it helps save money

Many view insurance as an expense, but it is actually an investment. An insurance company, upon receiving a premium, takes on the responsibility of helping its clients in the event of an accident. This means that having insurance reduces the direct financial burden on the policyholder’s pocket, offering significant economic benefits.

By purchasing insurance, you can save money and benefit from:

- Financial protection: insurance helps protect you from unexpected costs and losses that could lead to significant expenses.

- Risk mitigation: insurance helps reduce the financial impact of unforeseen expenses following an accident.

- Legal assistance: some insurance policies, such as legal insurance or liability coverage, provide access to legal services, representation, and advice, which also constitutes savings.

- Tax benefits: certain policies offer the right to deduct insurance premiums, leading to lower taxable income and potential tax savings.

The right decision to purchase an insurance policy

An appropriate policy not only ensures that you comply with the law but also provides financial protection in case of an accident, covering damage to other vehicles, injuries, and damage to your own car. Additionally, it can help cover medical bills and fill gaps in your health insurance, including hospital visits and, in some cases, a portion of lost wages if you are unable to work. Without insurance, you risk facing significant expenses for repairs and medical care, making having the right policy essential for your protection and peace of mind.

Purchasing insurance not only alleviates the financial burden but also reduces the stress and worry of dealing with accident-related situations without professional assistance. Moreover, for those working in the road transport industry, it is crucial to keep all documentation in order to avoid fines or even the suspension of a commercial license. Insurance is not a burden; on the contrary, it is the essential support every driver needs.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

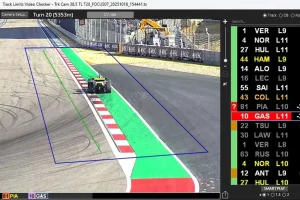

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,