Intermodal transportation is entering a decade of rapid worldwide expansion, driven by growing demand for logistics efficiency, mounting cost pressures, and the global shift toward more sustainable freight systems.

Intermodal transportation is entering a decade of rapid worldwide expansion, driven by growing demand for logistics efficiency, mounting cost pressures, and the global shift toward more sustainable freight systems. According to the report Intermodal Freight Transportation Market Forecast and Outlook 2025–2035, published by the international market intelligence firm Fact.MR, the sector is expected to reach USD 166.2 billion by 2035, nearly 3.1 times the estimated USD 54 billion in 2025. The projected 11.9% CAGR is unusually high for a traditionally conservative and asset-intensive industry such as freight logistics.

While the report highlights strong growth across emerging markets in Asia and Latin America, the United States stands out as one of the most influential engines behind global expansion. With a projected 12.2% CAGR through 2035, the U.S. is solidifying its position as one of the industry’s strategic hubs—supported by advanced rail infrastructure, high-volume cross-border trade corridors, and the rapid digitalization of its supply chain.

A Global Market in Transformation

Fact.MR’s analysis shows that intermodal transportation is undergoing a structural shift. Supply chains are moving away from single-mode transport models and migrating toward integrated multimodal networks that combine trucking, rail, inland waterways, and maritime transport. This transition is fueled by three core pressures:

• Lowering logistics costs in an inflationary environment.

• Improving reliability and achieving more predictable transit times, particularly for e-commerce, automotive supply chains, and agricultural products.

• Meeting environmental targets by increasing reliance on lower-emission modes such as rail.

The report notes that Asia-Pacific will lead global growth. India tops the projections with a 14.3% annual expansion, supported by industrial corridors and major rail modernization projects. China follows closely, with 13.1% growth driven by the Belt and Road Initiative, port automation, and booming e-commerce activity.

Europe also maintains a strong position. Germany is expected to lead the region by 2035 thanks to its highly integrated rail network, modern intermodal terminals, and consistently high operational efficiency—reaching a projected 12% CAGR.

United States: A Pillar of Global Intermodal Growth

While Asia is setting the pace for infrastructure investment, Fact.MR identifies the United States as a central pillar of the global intermodal market. The country’s market value is projected to grow from USD 13.8 billion in 2025 to USD 42.8 billion by 2035, propelled by four key drivers:

1. Surging Cross-Border Trade With Mexico and Canada

Under the USMCA framework, industrial flows among the three countries are reaching historic levels. Mexico’s nearshoring boom—combined with a resurgence in U.S. manufacturing—is fueling sustained demand for intermodal transportation, particularly along corridors such as Texas–Midwest, California–Mexico, and Great Lakes–Ontario.

2. Highly Competitive Rail Infrastructure

The United States operates one of the most extensive and efficient freight rail systems in the world, featuring:

widespread double-stack rail capability,

digitized and automated intermodal terminals,

and major operators like J.B. Hunt, FedEx Logistics, XPO Logistics, and C.H. Robinson, all cited by Fact.MR as dominant global players.

The road–rail segment, which will account for 45.8% of the global market in 2025, finds one of its strongest bases in the U.S., thanks to the long-distance efficiency of freight rail.

3. Rapid Digitalization Across the Supply Chain

Real-time visibility platforms, IoT devices, integrated tracking, and predictive analytics are transforming operations. According to Fact.MR, the U.S. leads the global adoption of automated systems in intermodal terminals—reducing dwell times, improving dispatch accuracy, and cutting operational costs.

4. Increasing Strain on the Trucking Sector

Driver shortages, rising fuel costs, and congestion along major highways such as I-5, I-10, and I-95 are pushing shippers toward rail-based intermodal alternatives. As a result, U.S. intermodal container volumes are growing at an annual rate of nearly 18%, particularly in retail, food distribution, and automotive supply chains.

Global Competition and an Industry in Reconfiguration

Fact.MR’s report shows a market composed of 30 to 50 significant players, where the top three—Oracle, C.H. Robinson, and DB Schenker—control between 25% and 30% of global share. Competition no longer revolves solely around pricing; reliability, network coverage, and technological capability are now decisive.

Another clear trend is the rise of the transportation & warehousing segment, projected to represent 35.6% of the market in 2025. Growth in this segment is driven by logistics outsourcing, warehouse automation, and the increasingly seamless integration between storage and multimodal transportation.

The U.S. Reinforces Its Strategic Weight in a Market Set to Triple

As global logistics face mounting pressures related to cost, speed, and sustainability, intermodal transportation is becoming essential for economic competitiveness. The Fact.MR report underscores that while Asia will drive much of the global expansion, the United States will remain one of the core pillars of worldwide intermodal growth—thanks to its infrastructure, commercial volume, and rapid technological adoption.

By 2035, the U.S. will not only maintain its leadership but will play a decisive role in shaping the evolution of the global intermodal market—an industry set to triple in size and fundamentally transform how freight moves across the world.

Truck driver: stop choosing the worst route

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

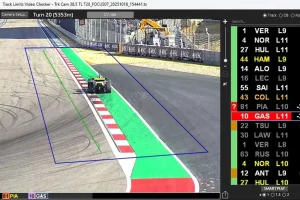

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,