If the Trump administration implements tariffs on Mexico and Canada, more than 50% of U.S. imports by volume would be affected.

When he took office in January, President Donald Trump initiated a trade dispute with Mexico and Canada by announcing that he would impose a 25% tariff on imports from these countries starting February 1. However, the White House postponed the deadline for this measure by a month after reaching some agreements on the border with both countries. Despite this, the imposition has not been canceled and will resume once the deadline has passed, which could have significant repercussions for all the involved countries.

In addition to the 25% tariffs on Mexico and Canada, a 10% tariff on China was announced. In response, Chinese President Xi Jinping announced the imposition of tariffs on products such as coal and liquefied natural gas (15%), crude oil, agricultural machinery, and large-engine vehicles (10%), further intensifying the trade battle.

According to data from Project44, the digital logistics company, if the Trump administration were to implement these tariffs, over 50% of U.S. imports by volume would be affected. Jenna Slagle, a senior data analyst at Project44, pointed out that Canada was the top destination for U.S. exports in 2024, accounting for 43% of the total. “It is the largest consumer of U.S. exports, both by volume and by value,” Slagle explained, as reported by TransportTopics.

Mexico, Canada, and China are the top importers of U.S. agricultural products, meaning that retaliatory tariffs would be particularly harmful to farmers. Additionally, the impact could extend to machinery manufacturers, the automotive industry, and many other sectors, warned Slagle.

Tariffs in the trucking industry: reduced freight volumes and increased operating costs

One of the most affected sectors would be road transportation. A sector that had expected moderate improvement in freight transportation for 2025 is now filled with uncertainty. Experts indicate that tariffs could reduce freight volumes and increase operating costs for carriers, who are already recovering after years of recession in the industry.

According to supply chain data from Motive’s First Quarter Economic Report, trade with Mexico reached record figures, with a 19.3% increase in truck crossings, while crossings to Canada fell by 4.7%. Although the initial impact of the tariffs on transportation and supply chains will be moderate, the real disruption is expected to be felt in the second quarter of 2025.

The increase in costs will be passed on to U.S. consumers and retailers, raising prices due to the tariffs and uncertainty. Trade between the U.S. and Mexico remains strong, with a 30% increase in trade through the Laredo port and a record of 677,000 truck crossings in October 2024. However, any prolonged disruption could alter long-term supply chains.

On the other hand, the Logistics Managers’ Index (LMI) estimated that tariffs on Mexico and Canada would result in an additional $185 billion in costs paid by importers. The most affected sectors would be automotive, oil and gas production, electronics, medical equipment, and food. Meanwhile, Chinese tariffs would increase costs by $225 billion to $230 billion, according to the LMI.

Manufacturers in Mexico and Canada

Freightliner, International, and Peterbilt are some of the truck manufacturers assembling various heavy models in Mexico. Since many parts are made there, production costs in the U.S. would also rise. The impact of tariffs could disrupt supply chains built over the last three decades through free trade, affecting both the automotive and trucking industries.

The United States-Mexico-Canada Agreement (USMCA) has allowed a third of the key inputs for U.S. manufacturing to come from Canada and Mexico. Since many parts and components are made south of the border, costs will also rise for truck manufacturing in the U.S.

A 25% tariff applied to Mexico could increase the price of a new Class 8 tractor by up to $35,000, representing an unsustainable cost for many small carriers and significantly raising the annual operating costs for large fleets. Moreover, it would severely affect these supply chains, particularly for small and medium manufacturers.

President Trump announced that more tariffs are forthcoming on products such as computer chips, pharmaceuticals, steel, aluminum, copper, and oil and gas imports. Tariffs will also be imposed on the European Union.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

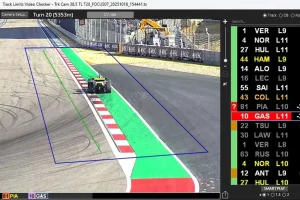

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,