Form 2290 must be filed annually by anyone who registers a highway motor vehicle in their name with a taxable gross weight of 55,000 pounds or more.

The deadline to file IRS Form 2290 for truckers is quickly approaching. This form applies to owners of heavy vehicles operating on U.S. highways and is required by the IRS to ensure proper collection of taxes used for maintaining road infrastructure.

Form 2290 must be filed annually by anyone who registers a highway motor vehicle in their name with a taxable gross weight of 55,000 pounds or more. The filing deadline for this return is August 31.

IRS Form 2290: FAQ

IRS Form 2290 is mandatory for owners of heavy vehicles with a gross weight of 55,000 pounds or more that are operated on public highways in the U.S. This form is used to report and pay the Heavy Vehicle Use Tax (HVUT), an annual requirement for carriers and heavy trucking companies.

Who must file?

Any individual or business that:

- Is the registered owner of a vehicle weighing 55,000 pounds or more.

- Puts the vehicle on the road during a tax year that runs from July 1 to June 30 of the following year.

- Operates the vehicle on federal public highways.

Required information

To file Form 2290, you’ll need:

- The name of the taxpayer or business.

- Employer Identification Number (EIN) – this is required. The IRS does not accept Social Security Numbers (SSN) for this form.

- Address and other contact details.

- Vehicle Identification Number (VIN).

- Taxable gross weight category, which includes the weight of the truck, any trailers, and the maximum load it carries.

The IRS provides a weight category chart to help determine the appropriate classification for your vehicle. The tax amount depends on the weight of the vehicle (heavier vehicles pay higher taxes) and the date the vehicle was first put into service. Truckers must refer to the IRS tax rate table to ensure they pay the correct amount.

Some vehicles may qualify for tax suspension, even if a return still needs to be filed. For example, vehicles that operate fewer than 5,000 miles per year (or 7,500 for agricultural vehicles) can request a tax suspension by selecting the appropriate option on the form.

Failure to file Form 2290 can result in penalties, including interest charges and fines. It is essential to submit your return on time to avoid these consequences.

Help filing Form 2290

The Permits and Licensing Department of the Owner-Operator Independent Drivers Association (OOIDA) is offering assistance to truckers and vehicle owners who need help filing Form 2290. To request support, you can contact OOIDA at 816-229-5791. Applications will be accepted until August 19 to allow sufficient time for processing.

Additionally, OOIDA has partnered with 2290s.com to make online filing fast and convenient. You can file Form 2290 from any computer by visiting: members.2290s.com/ooida.

If you still have questions, Saint George Insurance Brokerage Inc. is also here to help. Contact one of our agents and ask about our services related to Form 2290, we’ll be happy to provide the assistance you need.

The best roadside attractions for truckers in the U.S.

America’s highways hide unique places that break up the routine, don’t hesitate to check out these roadside attractions along the way. The road is much

The trucker style: comfort, function, and identity

Truckers’ style is much more than workwear; it’s an identity. These are the most commonly worn garments among truckers. Truckers’ style is much more than

Chaos on Highway 61: Viral Wrong-Way Truck Video Reignites the CDL Debate

An 80-ton tractor-trailer traveling miles in the wrong direction on Missouri’s Highway 61 has reignited a nationwide debate over Commercial Driver’s License (CDL) standards, training

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

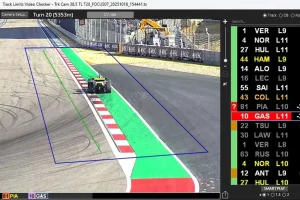

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,