Pennsylvania plans to modify electric vehicle taxes, California on bond approval and Florida designates truck parking budget

Pennsylvania: Taxes for Electric Vehicles

On December 11th, the House Transportation Committee voted in favor of a Senate-backed bill, with 22 votes in favor and 3 against, aiming to replace the alternative fuels tax for non-commercial electric vehicle owners in Pennsylvania with a fixed fee.

Currently, affected vehicle owners are required by the state to submit monthly statements to the Department of Revenue, in which they must remit the alternative fuels tax based on their electric vehicle’s power consumption.

Republican Senator Greg Rothman highlighted that the majority of electric vehicle owners do not fulfill tax payments, either due to the complex process or simply lack of awareness. Rothman pointed out that some find the process burdensome or are unaware of the obligation.

The proposed bill, SB656, seeks to exempt non-commercial electric vehicle owners up to 14,000 pounds from the tax and replace it with an annual fixed fee of $290. If approved, this fixed fee would be the highest in the country for electric vehicle owners. It’s essential to note that the bill does not include hybrid vehicles or commercial electric vehicles.

Estimated revenues of $9.2 million annually from electric vehicles would be allocated to the State License Plate Fund for highway maintenance and construction.

California: Proposed Changes in Approval Threshold for Bonds

Next fall, California voters will have the opportunity to decide on a potential modification to the state constitution, reducing the approval threshold required to authorize bonds for projects involving local road and bridge works.

Currently, California’s constitution mandates a two-thirds majority vote for the approval of general obligation bonds and special taxes at the local level. However, state legislators have approved a constitutional amendment proposal, known as Assembly Constitutional Amendment 1, aiming to reduce this threshold to 55%.

This proposed amendment specifies that the new threshold would apply to local general obligation bonds and special taxes when explicitly designated for the construction, reconstruction, rehabilitation, or replacement of public infrastructure in a city, county, or special district. Notably, this category encompasses transit improvements as well as street and road enhancements.

The initiative aims to streamline the approval process for critical infrastructure projects, offering voters the chance to decide on this rule change on the ballot next fall.

Florida: Transportation Budget for Fiscal Year 2024-2025

Governor Ron DeSantis has unveiled his transportation budget proposal for the upcoming fiscal year, titled “Focus on the Future of Florida.” This budget plan for the fiscal year 2024-2025 allocates $25 million specifically to address the need for truck parking.

Within this focus, a substantial amount of $15.6 billion is designated for transportation, with the goal of alleviating critical congestion and supporting safety projects. The governor’s administration emphasizes that this proposal will allow the Florida Department of Transportation to continue leading in technology and transportation infrastructure while fostering a robust and efficient supply chain.

The budget for the Florida Department of Transportation’s work program encompasses $14.5 billion, with specific allocations for various projects, including road maintenance and construction, repaving, bridge repairs and replacements, investments in maritime ports, railway and public transportation investments, and safety initiatives.

In addition to the proposed budget, DeSantis has recommended allocating $25 million to address the shortage of commercial truck parking along the state’s highway system. The proposed investment aims to further strengthen transportation infrastructure and associated services in Florida.

How technology affects driver retention

Friend or foe? 52% of drivers say technology directly influences their decision to stay with or leave a fleet. Fleet telematics company Platform Science published

Dalilah Law seeks to remove non-english speaking commercial drivers

President Donald Trump proposed the “Dalilah Law,” an initiative aimed at prohibiting undocumented immigrants from obtaining commercial driver’s licenses. On February 24, President Donald Trump

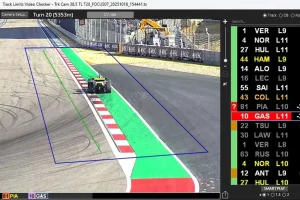

FORMULA 1 and the AI That Could Transform Transportation in the U.S.

The artificial intelligence system that Formula 1 implemented to monitor every car on every turn is opening the door to new applications in trucking, logistics,

$170 billion at stake: 1,500 companies demand tariff refunds

Companies have challenged the global tariffs imposed by President Donald Trump, asking federal courts to reactivate proceedings to begin the refund process. The companies that

In brief: enforcement measures target speeding, CDL training gaps and more

Major enforcement actions across the U.S., including speeding, CDL fraud, and chain violations Colorado launches Speed Enforcement Program The Colorado Department of Transportation (CDOT) has

Chinese Vehicles Raise Espionage and Remote Sabotage Concerns

Investigations into Chinese technology in connected vehicles warn of espionage risks, massive data transmission, and potential remote access vulnerabilities that concern U.S. transportation and security