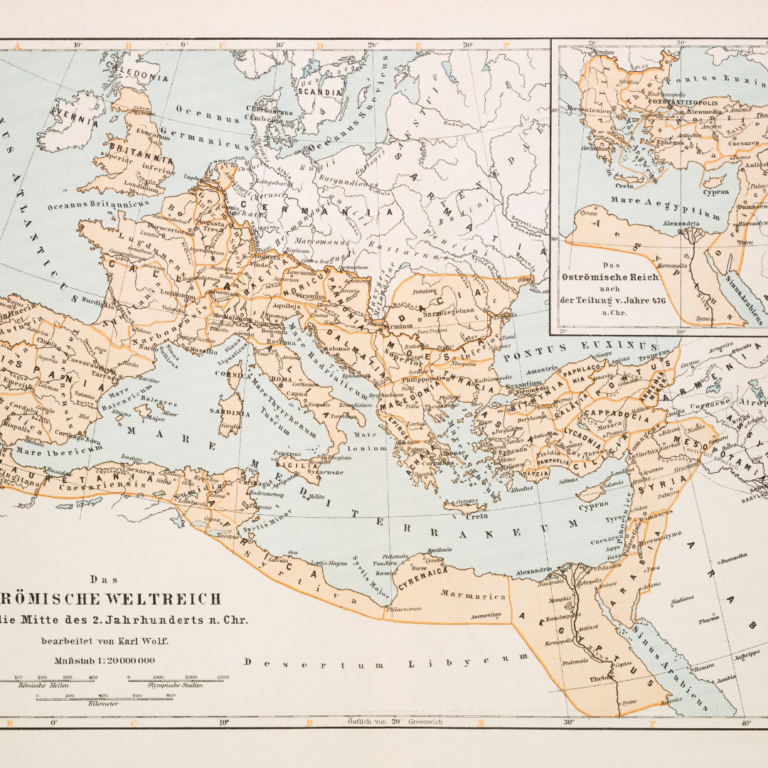

The Egyptians, Phoenicians, Babylonians, Romans and Greeks... All of these great civilizations invented the insurance we know today.

Is insurance a kind of contract established in modernity? When did they emerge? Because? Researchers from the University of Cuyo, Argentina, determined that – although it is difficult to define the exact date – the beginning of insurance is established in 1759 BC. A moment where the king of Babylon, Hammurabi, gathered all the codes that circulated in the Mesopotamian Empire.

At that time, not only were the debtors protected and their debt forgiven in the event of a catastrophe, but the ships were also protected. If a sailor suffered the loss of his boat, the insurance determined that the others had to build one for him. This only happened if the captain had not committed any mistake. In that case, he lost his ship.

Now, if that story seems incredible, there is another one that is even more so. In 3 thousand BC the Chinese had insurance to protect themselves from the power of the rivers and their damage. And the Egyptians, one of the world’s great civilizations, implemented life insurance.

Ship and cargo insurance

The insurance journey continues; Faced with this panorama, the Phoenicians took the insurance business towards a new figure: they invented insurance brokers. They also focused on marine insurance. To protect those whose missions ended in failure, the Phoenicians initiated two lines of action. The first was the loan given by those who had a lot of money to finance transportation and insure the cargo. And then, the beginning of paying a fee in advance to have insurance also aimed at transportation. That is, the premium as we mentioned it today.

The Phoenicians thought much more. This premium that was paid in advance had to have a procedure, a way of appraisal. And that is why these experienced merchants created the risk assessment, which was simply evaluating the risk that existed by analyzing the operation that was going to be carried out with the transportation plus the value of the entire cargo. Thus, it was possible to determine what amount this ship had to pay to obtain its insurance.

Maritime trade insurance became commonplace as did the well-known cargo insurance that is provided to this day.

Rome: life, illness and activity protection insurance

The Romans and Greeks incorporated their own system. In Rome they adopted what was called bulk loans. This method protected them in case of problems with their transportation and with the goods. But in Rome they also thought about families, in a clause wives and children received compensation in case of accident and death of the husband.

It was Domitius Ulpianus who created the first table known as the probability of death. This table analyzed the age of the person and, for example, variables such as the mortality rate of men or women. Together with other analyzes it was possible to determine what possibility the person had of dying within a certain period of time.

Activity and illness protection insurance

The Romans also created tuition fees, that is, professional colleges. This group of people with common interests protected themselves from the particular risks of their profession. Each member of the collegia contributed money that was used to compensate their families when they died.

The same contribution covered them in case of illness or in case of robberies and attacks. Thus, the Romans, like the Phoenicians, made great contributions to the world of insurance. Particularly in the quest to provide this tool with the mission of reducing all risks for residents and protecting loved ones.

The first insurance company was born after a great fire that occurred in 1665 in England. In four days, an immense fire left 200,000 people homeless and destroyed no less than 13,000 homes. It happened in London and the flames advanced quickly, generating desolation and a true tragedy.

Such a loss led men to look for a shelter that would protect them from the inclemencies of nature. Thus, Nicholas Barbon, who was a doctor, economist and builder, made a kind of sketch of fire insurance. This generated the birth of the first insurance company.

$170 billion at stake: 1,500 companies demand tariff refunds

Companies have challenged the global tariffs imposed by President Donald Trump, asking federal courts to reactivate proceedings to begin the refund process. The companies that

In brief: enforcement measures target speeding, CDL training gaps and more

Major enforcement actions across the U.S., including speeding, CDL fraud, and chain violations Colorado launches Speed Enforcement Program The Colorado Department of Transportation (CDOT) has

Chinese Vehicles Raise Espionage and Remote Sabotage Concerns

Investigations into Chinese technology in connected vehicles warn of espionage risks, massive data transmission, and potential remote access vulnerabilities that concern U.S. transportation and security

Between the Court and the Fed: the market redefines its roadmap for 2026

Trade policy in limbo as markets price in 2026 rate cuts and Supreme Court strikes down Trump tariff plan. In the latest episode of the

New 10% U.S. import tariff takes effect amid legal and market uncertainty

The implementation of these new tariffs has generated global uncertainty among exporters, increasing confusion around U.S. trade policy. The United States has implemented a new

Military Trucks That Moved a Base in Syria

Convoys of advanced HEMTT and PLS military trucks carried armored vehicles, prefabricated base structures, mobile workshops and heavy equipment during the U.S. withdrawal from northeastern